reverse sales tax calculator texas

Price before Sales Tax Final Price 1 Sales Tax If you need to use the Tax sales Calculator for several products at once it is handy to use Excel per formulas and. For a state by state table of sales tax rates for 2022 see State and Local Sales Tax Rates 2022.

Texas Sales Tax Calculator Reverse Sales Dremployee

Last create a proportion where the pre-tax value is proportional to 100 and solve for the percentage of sales tax.

. Add the sales tax value to the pre-tax value to calculate the total cost. Formulas to Calculate Reverse Sales Tax. You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax.

Divide 1100 by 11 and you get 1000. Reverse sales tax calculator texas Sunday May 1 2022 Edit. Subtract that from the receipts to get your non-tax sales revenue.

Reverse Sales Tax Calculations. To find the original price of an item you need this formula. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Enter the total amount that you wish to have calculated in order to determine tax on the sale. For example suppose your sales receipts are 1100 and the tax is 10 percent.

Multiply the result by the tax rate and you get the total sales-tax dollars. Multiple the pre-tax value by the newly calculated decimal value in order to find the cost of the sales tax. Tax rate for all canadian remain the same as in 2017.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

New York City Sales Tax Calculator. Input the Tax Rate. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681.

For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Vermont has a 6 general sales tax but an. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

Current HST GST and PST rates table of 2022. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The only thing to remember in our Reverse Sales.

Enter the sales tax percentage. In Texas prescription medicine and food seeds are exempt from taxation. Not all products are taxed at the same rate or even taxed at all in a given.

To add tax to the price of an item multiply the cost by 1 the sales tax rate as a decimal. You can use this method to find the original price of an item after a. This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. For more detail that may include local tax rates or type of purchase you need to consider see Wikipedia Tax Tables by State. In Texas prescription medicine and food seeds are exempt from taxation.

Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. Amount without sales tax GST rate GST amount. The formula looks like this.

And all states differ in their enforcement of sales tax. See the article. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Before-tax price sale tax rate and final or after-tax price.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total taxable income. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top.

If the sales tax rate increased for example from 00025 to 0005 the taxing unit must have two sales tax projections. That entry would be 0775 for the percentage. 855-335-3500 New Car Sales.

This script calculates the Before Tax Price and the Tax Value being charged. For example if you paid 2675 for items. Divide your sales receipts by 1 plus the sales tax percentage.

The formula looks like this. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. In Texas can a reverse mortgage be approved if.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes. Instead of using the reverse sales tax calculator you can compute this manually. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. Changing the Additional Sales Tax Rate. We can not guarantee its accuracy.

The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars. If the taxing unit either increases or decreases the sales tax rate from last year the taxing unit must perform an additional step to determine the projected sales tax. Here is how the total is calculated before sales tax.

Amount without sales tax QST rate QST amount.

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total

Stripe Tax Automate Tax Collection On Your Stripe Transactions

How To Calculate Sales Tax In Excel Tutorial Youtube

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Texas Sales Tax Table For 2022

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator 100 Free Calculators Io

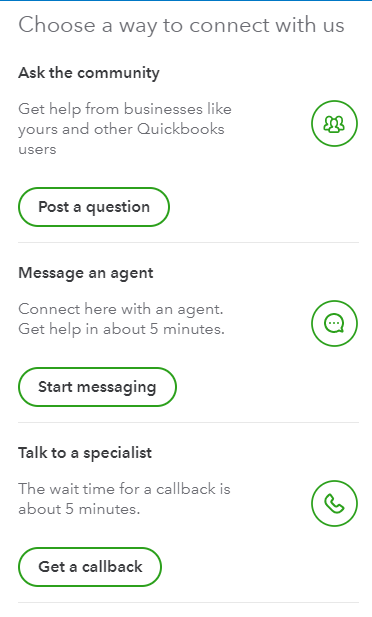

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator Calculator Academy